Before the delivery era, Master Kong (康师傅 Kāng shīfu), alongside jiānbing and bāozi, served as a life saver when it came to having burnt through all your money at the end of the month. I’m not talking about the overpriced RMB 38 noodles at their Master Kong Chef’s Table chain restaurants, but their dependable, but arguably bowel-rotting, RMB 5 instant noodles.

You can imagine our heartbreak at hearing rumors swirling around that this beloved Chinese brand was to be shut down, immediately after the announcement that Master Kong would be closing its subsidiary company in Taiwan on January 1. From that point on, Weibo was alight with messages such as, "run to the supermarket and grab several bowls of Master Kong instant noodles to memorialize that familiar flavor!"

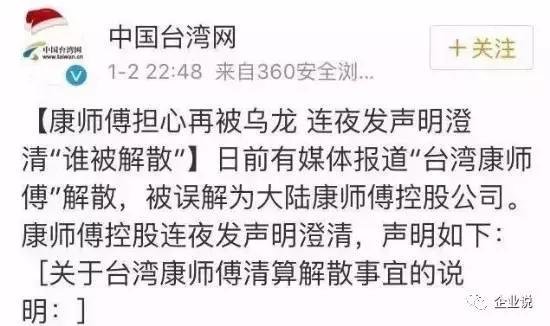

Sensing the fear, mayhem, and potential riots bubbling on the mainland, much like a hot cup of instant noods, the Tingyi Holding Company, owners of the Master Kong brand, were forced to issue their own statement via Weibo on January 2, stating that they would only “shut down the subsidiary in Taiwan, and focus mainland China market.”

The Tingyi (Cayman Islands) Holding Corporation was founded in Taiwan in 1991 and is the largest producer of instant noodles in China. On top of that, they currently own 24 chain sit-down restaurants in Beijing. The company was embroiled in a gutter oil scandal in 2014, forcing the Taiwanese factories to cease producing instant noodles, a move which they never recovered from.

In 2012, Chinese citizens consumed 44 billion packs of instant noodles, half of the world's overall consumption of the foodstuff, according to this Sohu report. But since its peak in 2014, sales have been dropping steadily, with Master Kong's current sales volume sits at the same amount as it had four years ago – a still sizeable 42 percent of the entire market.

Their biggest competitor is Uni-President Enterprises Corporation, which was founded in 1998, also in Taiwan, which is also the company behind Starbucks, 7-Eleven, Mister Donut, and Carrefour in Taiwan. Ironically, in the first half of 2016, net profit of Uni-President grew 12.9 percent to RMB 0.77 billion, the first time that it had exceeded Master Kong's.

In the first three quarters of 2016, Master Kong’s product revenue dropped year-on-year, predominantly because of the rising cost of one of its ingredients: palm oil. Between its glory days in 2011 to the end of 2016, the total market value of Master Kong has dropped a whopping HKD 90 billion from HKD 140 billion to HKD 52.8 billion.

The other reasons behind this massive drop in revenue? Master Kong hasn’t released any new competitive products in the past 10 years, relying instead on its trusted roasted beef flavor pot. Students and China's workers alike used to gobble down these mobile and convenient meals like there was no tomorrow, but now with omnipresent delivery service and people’s increasing concerns with eating healthy, the want to indulge in a tub of instant noodles is becoming harder to stomach.

More stories by this author here.

Email: tracywang@thebeijinger.com

Twitter: @flyingfigure

Instagram: @flyingfigure